Tuesday’s vote on an ordinance to establish regulations in public right-of-ways for utility companies was put on hold by the Chestertown Council because of a legal challenge.

ThinkBig Networks and Talkie Communications have been in a highly competitive race to connect customers to highspeed fiberoptic Internet in Chestertown. As a result, both companies have accidentally damaged water or sewer lines.

Both companies often use the same subcontractor to install the fiber.

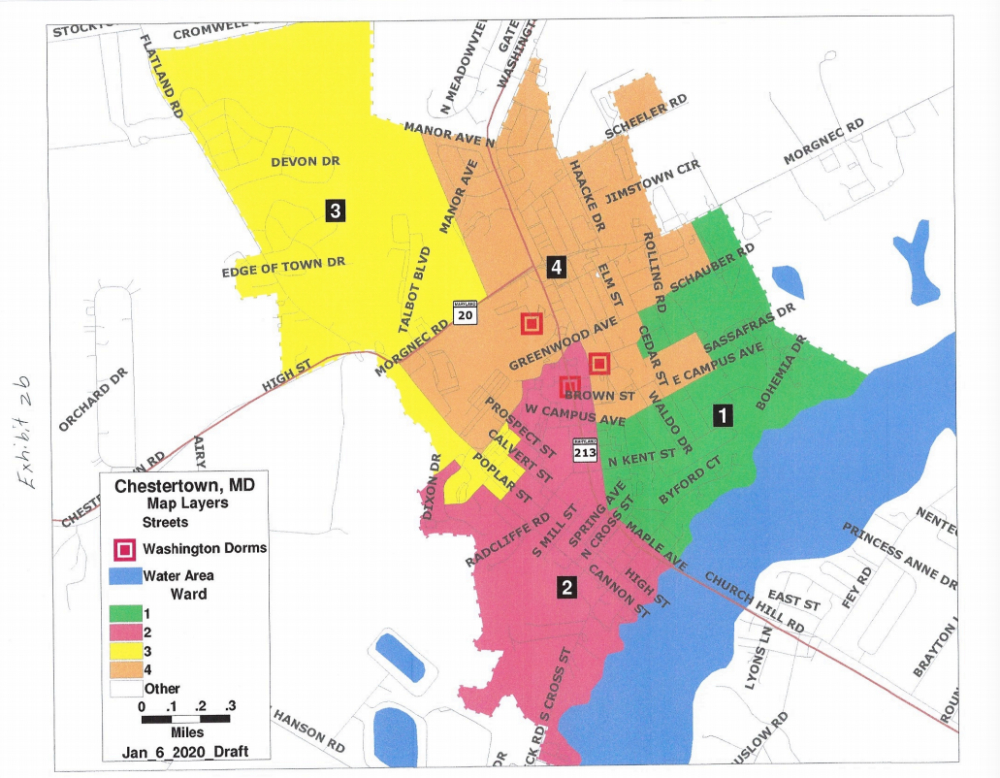

“We have sort of an impasse where two fiber companies want to wire the same neighborhoods at the same time and they might feel like they have a valid reason for doing that,” said Chestertown Town Manager Bill Ingersoll at Tuesday’s council meeting. “One has threatened a suit. For that reason, I would say we listen tonight…and not enact the ordinance.”

Talkie has sought legal counsel to force the town to honor a permit that was approved in August. The company said it was later told that two providers could not serve the same areas in town.

Talkie argues that this is a violation of FCC law, which prohibits barriers to businesses providing telecommunications services.

Talkie Co-founders Andrew and Andre DeMattia believe they were given a “bad shake” by the town when they began installing fiber last May.

Talkie Co-founders Andrew and Andre DeMattia believe they were given a “bad shake” by the town when they began installing fiber last May.

“When we were first greeted in the town…the first statement was ‘we don’t need fiber here, we already have ThinkBig, Maryland Broadband and Atlantic Broadband; we don’t want anybody else here’,” Andrew DeMattia told the council. He said the town office told this directly to his engineering contractor.

The two brothers said they were committed to Chestertown and have staked their personal fortunes to connect 300 customers so far.

“Talkie has committed to this town and has committed private funds of almost $7 million,” said Andrew DeMattia.

The arrival of Talkie in May of last year challenged the business plan of ThinkBig, which believes that Kent County and Chestertown are too small for the two companies to prosper, said Dee Anna Sobczak, COO of ThinkBig Networks.

She said that two companies laying fiber in the same areas was not a sustainable business model and she made a sales pitch to the council to select ThinkBig as the right provider for Chestertown.

“Kent County and Chestertown do not have the population numbers to sustain two fiber companies,” she said. “Most likely one of the companies won’t survive…or worse case both companies won’t survive.”

She said her company should be the provider of choice in Chestertown because of the company’s deep pockets.

“We have a very diverse investor pool,” Sobczak said. “It’s conservative to say that our collective personal net worth of our investors is north of $200 million.”

“I’m confident that when you do your research the answers will show that ThinkBig Networks is the right company for this,” she said.

Chestertown Mayor Chris Cerino pushed back on the idea that the council can choose a preferred provider.

“I don’t think it’s our job to pick one company over another,” Cerino told Sobczak. “That does get to a legal question. “What [the council] is being told is that utility companies have a right to these right-of-ways.”

Cerino said his job was to protect the town’s underground utilities.

“My biggest concern is not to pick one company over the other, but to protect our pre-existing resources,” he said.

He said if the council tried to pick one carrier the town would be subject to litigation.

“We are in my view caught in a private sector squabble,” he said. “I hope both of your companies kick ass and make a ton of money.”

In an email on Thursday, Andre DeMattia said there was plenty of room for more than one provider to service customers in Chestertown.

“All Internet providers can prosper side-by-side in Kent County and Chestertown,” Andre DeMattia said. “The community benefits from competition that brings lower prices and better services for everyone.”

In the video below Cerino questions Talkie on the need for two Internet providers in town.

In the video below Cerino explains to Sobczak why the town can’t pick one preferred Internet provider.