A liberal-leaning think tank is pressing for passage of a series of revenue bills targeting business loopholes and tax breaks ― by looking back at what could have been.

The Maryland Center on Economic Policy released a memo on Thursday detailing $2.8 billion in revenue that could have been raised by their bill package if lawmakers had passed the measures last term.

The center, which produced the memo independently, is part of the Fair Funding Coalition, which is pressing for passage of 10 bills that they say would close corporate loopholes, end policies that benefit special interests and establish a more equitable income tax system in the state.

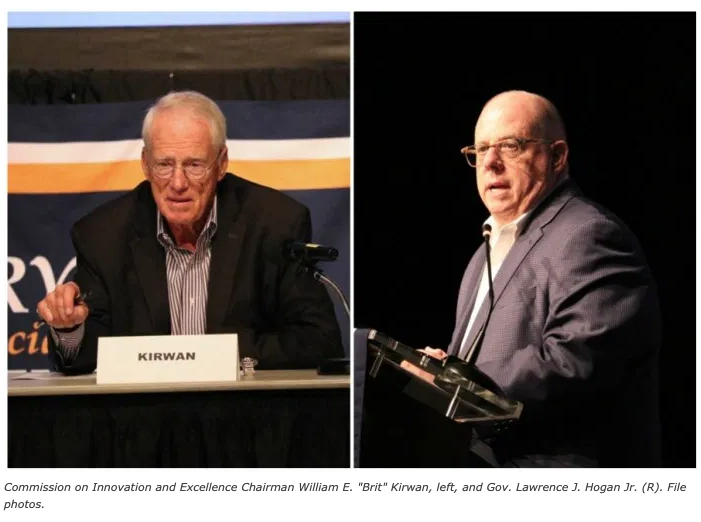

The goal of the proposals is to raise dedicated revenues to help the state cover the costs of Kirwan Commission education reform proposals, which could become substantially more expensive in coming weeks as lawmakers consider tweaks to relieve local spending mandates.

“We made it much harder on ourselves because we didn’t take these steps sooner,” said Benjamin Orr, executive director of the Center on Economic Policy.

The analysis found that eliminating pass-throughs in corporate tax reporting and implementing combined reporting for multi-state corporations could have generated more than $1.8 billion between 2014 and 2018.

The center also would have ended some businesses subsidies during that time period, amounting to $194 million.

Levying a 1% state surtax on capital gains would have generated $455 million, and closing the “carried interest loophole” by taxing income of investment fund managers at 17% ― instead of the lower capital gains tax rate ― could have generated $209 million.

Orr said he was still optimistic that lawmakers might pass one or more of the measures included in the analysis this legislative session. The bills, he said, would minimize impact on low- and moderate-income residents while, in cases like combined reporting, bring Maryland in line with the majority of other states.

Sen. Paul G. Pinsky (D-Prince George’s) has introduced a combined reporting bill for more than a decade.

“We would have had a hell of a lot of money,” Pinsky said, if his bill had been passed earlier.

He believes there’s still a chance that his bill and others could be part of a revenue package advanced this session, and that it makes sense to focus efforts to raise revenue for education reforms by focusing on businesses.

“I hear from some of these companies that say we have jobs, but we don’t have people to fill them. So I think there’s a nexus between them paying their fair share and investing in education, because they’re the ones who are going to take advantage of it,” Pinsky said. “We’re the ones preparing their future employees. I think it’s way past due.”

The Center on Economic Policy’s push for business tax reform has been boosted by Warren Deschenaux, who retired as the General Assembly’s long-serving top fiscal analyst in 2017.

On Thursday, he said it was critical that lawmakers increase state revenues not only to fund education reform, but also to address the state’s structural deficit.

“If you look at the outlook, things are rather grim ― and that’s before anything bad [like a recession] happens,” Deschenaux said.

The Fair Funding Coalition’s package of bills are just a small portion of an influx in revenue measures introduced this year, encompassing everything from sports betting to digital downloads and a recent proposal to dramatically expand the state’s sales tax to services.

A hearing on the sales tax proposal ― which sponsor Del. Eric G. Luedtke (D-Montgomery) has said could generate an additional $2.6 billion ― is expected to draw strident opposition from corners of the business community on Monday.

Orr said while the center has endorsed limited sales tax expansions for specific services in the past, it has not yet taken a position on the broader 2020 sales tax proposal.

“Our top priority remains closing loopholes and getting rid of tax breaks that only benefit special interests,” he said.

Deschenaux said the sales tax proposal could end up making the other proposed revenue bills more attractive to lawmakers in contrast.

“Some of those consumers are wealthy and they’re getting lawyer advice and having their taxes done,” he said of the proposed tax on services. “But a lot of those people are having their dry cleaning done, their cars repaired, and so forth. And so it reaches perhaps more broadly than one might prefer.”

by Danielle E. Gaines