Preview of the presentation to the County Commissioners boardroom with Mayor David Foster Presenting “Major Double Taxation/Tax Differential Study by University of Maryland Experts,” Tuesday, April 9, 1 pm meeting.

Chestertown residents and businesses pay, at least 10-15 % more in County taxes than they should, a new detailed, in-depth study by two University of Maryland finance scholars confirms.

And that 10-15 percent extra burden is a conservative estimate, the two experts say.

Townspeople are taxed twice, paying for both town and county roads, town police, and county sheriff, while people living in the county, but outside the municipal boundaries, pay nothing for those municipal services.

Mayors in Kent County have raised this issue since 1997, when Chestertown Mayor Margo Bailey requested a similar study by the University of Maryland. Today’s new study confirms that nothing has changed.

Ironically, when asked why Kent County can’t compensate municipal citizens for double taxation, as most other Maryland Counties do, our three commissioners repeatedly claim that “Kent County is too poor.”

And yet, in Kent County, it is low-income areas that are currently required to subsidize services in high-income areas.

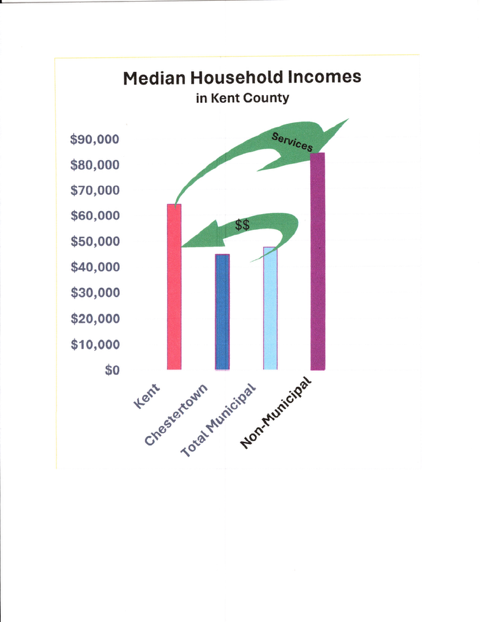

Obviously, rich and poor live in both municipal and non-municipal areas, but the evidence is clear that both the Median Incomes and Mean Incomes (see definitions at the end of this memo) are lowest in Chestertown, and highest in the non-municipal areas of our county.

Kent County currently over-taxes relatively low-income townspeople, in order to avoid raising taxes on high-income people outside towns.

Not only is the current system inequitable, but it also handicaps the very areas crucial to development.

When Chestertown is over-taxed, in order to keep property taxes low on the surrounding countryside, this results in a penalty of 20% to 30% (10% to 15% over-tax on Chestertown + 10% to 15% under-tax in rural areas).

A tax gap of this magnitude on municipalities with good infrastructure, makes it all the more difficult to attract new businesses and the employees that might work there.

The Maryland Department of Planning emphasizes that failing to provide a property Tax Differential undercuts the very basis of the State’s Program of Priority Funding Areas.

Respected economist Anirban Basu has stated that these penalties harm both towns and counties because they prevent towns and cities from playing their natural role as “engines for economic development” of their counties.

Finally, it is evident that when counties arbitrarily increase the costs of living and running businesses in their towns, they encourage urban sprawl, thus increasing the cost of providing critical infrastructure, while also eating up valuable agricultural land and wildlife habitat.

Many of the richest citizens of our county live in million dollar plus homes on land on the downstream Chester River and its multiple broad creeks.

For example: compare the Median Household Income (MHI) of the non-municipal areas of Kent County of $83,877 per resident, with a population of 19,320….. versus Chestertown’s MHI of $44,665, population 5,557. That’s a gap of almost $39,212 per household! So lower-income people in Chestertown are being overtaxed to subsidize services in higher-income rural areas: i.e., rural county-wide median salaries are a staggering 77 percent higher than in the five towns in Kent County.

None of our three County Commissioners lives in Chestertown, which they agree is the “economic heart” of the county. And verbal public commitments by two of them, on election eve in November 2022, that they would at least support a study of tax differentials, was reneged on after the election.

To repeat, all three commissioners pleaded “we have no money” to share the modest costs of a study. Well, the study, paid for by our Town Council, was worth every penny in refuting the capricious, arbitrary, evidence-free, threadbare statements by The Three.

Again, non-town residents of the county are UNDERtaxed, while the people of Chestertown are demonstrably OVERtaxed.

A tax differential correction would return between $617,900 and $913,000 to the people of our town. That money could be used to reduce property owners’ taxes, or fund larger investments to significantly improve all town services.

Right now, this tax unfairness is a deterrent to new businesses and employees coming to Chestertown.

This has to change – now!

( here, below, is an explanation of terms/details within the new study:

- A “Tax Rebate” is defined as money paid by the County directly to the Municipality

- A “Tax Differential” is defined as a reduced tax rate for Municipal taxpayers

- Non-Municipal Median Household Incomes in Kent County are 87.79% higher than those in Chestertown

- Non-Municipal Median Household Incomes are 76.71% higher than those in all five Municipalities combined

- The Maryland Study uses Median Incomes rather than Mean Incomes because a few extremely wealthy households can change the Mean, while the Median is widely regarded as a better indicator of overall ability to pay)

By Mayor David Foster, and Michael McDowell

Mike Waal says

Regards Kent County, Maryland, not being a wealthy County, “too poor,” information sourced from the State Aid Formula Wealth Data Spread Sheet Final Wealth Calculation, of the 24 jurisdictions in Maryland [Note: their column titles]:

Kent County ranks 23rd in the State, column 1, Net Taxable Income;

Kent County ranks 23rd in the State, column 2, 100% Assessed Value of Operating Real Property of Public Utilities;

Kent County ranks 22nd in the State, column 3, 40% Assessed Value of All Other Real Property;

Kent County ranks 24th in the State, column 4, 50% of Assessed Value of Personal Property;

Kent County ranks 23rd in the State, column 6, Total Wealth;

Kent County ranks 24th in the State, column 9, Personal Property: Utility Operating;

Kent County ranks 24th in the State, column 11, Personal Property Subtotal;

Kent County ranks 22nd in the State, column 12, Real Property: Full Year;

Kent County ranks 24th in the State, column 13, Real Property: New Construction;

Kent County ranks 22nd in the State, column 15, Real Property: 40% Subtotal;

Kent County has no ranking, column 5, 40% of TIF Adjustment;

Kent County has no ranking, column 10, Personal Property: Business;

Kent County has no ranking, column 14, Real Property: Railroad Operating;

Kent County has no ranking, column 16, Qualified TIF Adjustment.

Information sourced from the latest United States Department of Commerce, Bureau of Economic Analysis:

Kent County ranks 24th in the State, Gross Domestic Product.

Regards “Right now, this tax unfairness is a deterrent to new businesses and employees coming to Chestertown.”

It might be that businesses not coming to Chestertown, and Kent County on a larger scale, is more a function of Maryland’s unfriendly business rankings:

Maryland ranks 5th highest gas tax in the nation;

Maryland ranks 7th highest minimum wage in the nation, and for good reason;

Maryland ranks 7th highest cost of living in the nation;

Maryland ranks right around the 40th worst state to do business in, start a business in, sourced from Forbes & CEO magazines;

Maryland ranks 11th worst state when looking at just the 15 states along the I-95 corridor from ME to FL.

And, least we forget, the Maryland General Assembly just past a boat load of legislation for new and increased taxes and fees.

Just a few years ago, Chestertown lost a top-ten employer, USA Fulfillment, which moved to Delaware. Not because of Kent County and Chestertown taxes, but because of Maryland’s overall business climate vs Delaware.

Some sources rank Delaware as the 2nd most business friendly state in the nation.

When business owners and decision making managers look at metrics to decide where the best place is to expand their business, start a business, relocate an existing business, would we, should we, expect them to take a look at Maryland as a whole?

Deirdre LaMotte says

Yes, and because of this Delaware ranks #1 as the most

hideous state. That is what happens when there is no zoning and businesses are welcome to do what they please: pave over extraordinary farmland for liquor stores, plastic houses and gas stations.

Good luck to anyone not able to live in Greenville, DE.

Mike Waal says

Yes, Deirdre, u r correct, & with an acute sense for the obvious, that is why business owners and decision making managers by pass MD for DE, or South Carolina or North Carolina.

We may not like it, but it is reality. DE, SC, NC are usually in the top 5 of rankings for business friendly states.

Deirdre LaMotte says

So, quality of life for its citizens are way below

the needs of businesses. I really do not believe that is what anyone wants….but business.

Renae says

Socialism 101

Deborah Becker says

So you want the suburbs to pay for Chestertown and Rock Hall police? Are you giving paid trash pickup to the entire county? Are the suburbs supposed to pay for the Rock Hall water system and new sidewalks in Millington? There are perks in town that we suburbanites don’t have! Perhaps the tax calculations need some tweaking but it shouldn’t be based on median household income! That’s ridiculous! And my MHI is a lot closer to a Chestertown residents than to the suburban MHI!