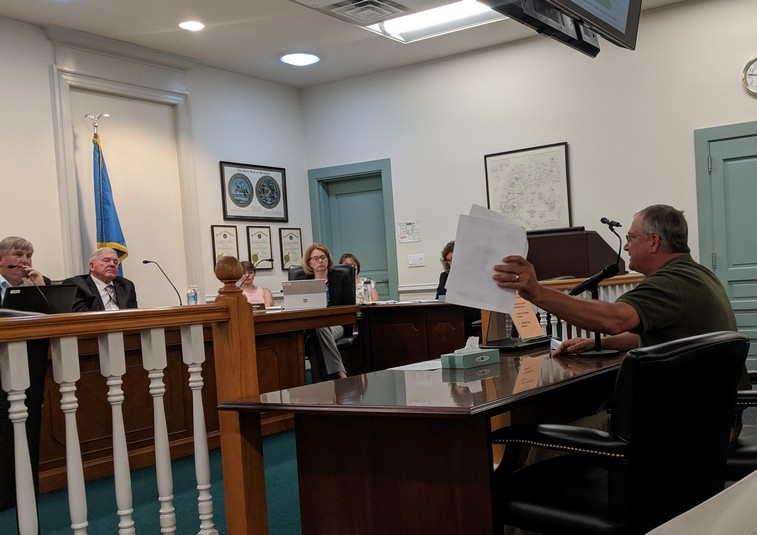

Chestertown Mayor Chris Cerino (right) testifies at the Kent County public hearing on the FY2020 budget

Chestertown Councilman David Foster and Mayor Chris Cerino gave the Kent County Commissioners a scolding Tuesday evening, June 4, at the county’s public hearing on the Fiscal Year 2020 budget.

The two elected officials took the commissioners to task for the county’s failure, for the fifth year running, to provide a tax differential or rebate to the town. The idea is to compensate town residents and the municipal government for services provided by the town for which they are billed in the county tax rate. In the case of Chestertown, those services include police protection, road repairs and maintenance, and planning and zoning. While the county taxes town residents the full amount that all county residents pay, it does not, on the whole, provide those services within town limits.

Describing the budget negotiations as “a very difficult assignment,” Commission President Tom Mason said the county had set aside “a placeholder” for a tax rebate to towns but decided after examining the budget as a whole to give it to the schools instead. “We can only do so much with what we have,” he said. He said the commission decided not to increase the property tax rate because it would present a hardship to many property owners, who are already facing one of the higher rates on the Shore.

Mason said the county had budgeted for an increase in the county’s “piggy-back” addition to the state income tax rate to the state-allowed maximum of 3.2%. He said the increase would provide about $1.6 million over three years, which would give the towns, “especially Chestertown,” a “substantial” increase in their income, making it unnecessary to set aside a tax rebate for them.

Kent County Commissioners (from left) Bob Jacob, Tom Mason, and Ron Fithian

Foster, who has made the tax differential a signature issue, was the first of several public officials to address the commissioners. He said, “Like most folks, I hate to see my taxes go up, but I recognize that sometimes it’s necessary to provide critical services. […] But somehow, those people who provide services somehow forget that many of us live in Chestertown. The sheriff rarely comes to town. The county street crew, paid to shovel our streets, somehow rarely get here.” He asked the commissioners to imagine how a resident of one of the town’s wards would feel if the town decided not to provide equal services to that ward. “Now, if Delmarva [Power] would have charged me the same rate as everyone else but provided me with half the services, I’d call that fraud. Wouldn’t you? What should we call it when local government charges us full range but provides half of the services, solely because of our location?”

And if the towns are, on their own, providing the services the county doesn’t, Foster asked, “Why should you not provide a tax differential to the citizens who do not get county services, like virtually every other county in our state? I’m still trying to find out what is so unique about Kent County that you can’t strive to meet your obligations.” Foster went on to say, “I know that you’re working hard for economic development. So I just cannot understand why you penalize precisely the areas that are most suited and most likely to attract small businesses. […] I know that you’re working hard. And I hope that you will recognize that we’re not asking for charity. I’m simply asking for the services we’re paying for.”

Cerino said, “It is extremely disappointing that for the fifth straight year I’ve come and asked and put this issue every way I possibly can to make it crystal clear why the town of Chestertown in particular, but also the town of Rock Hall, deserve a tax differential or a tax rebate.” After pointing out that the two towns, which have a population of about 6,500 between them – nearly a third of the county – pay the full county tax rate, Cerino noted that the two towns have their own police departments, their own road crews, and their own planning and zoning. “Which not only takes millions of dollars off of your plate every single year, we’re also essentially paying you for services you know you don’t provide within the town. […] We are paying for phantom services. Every other county in the state that has incorporated towns has figured this out by either lowering the county tax rate within the town or by cutting a check to the towns, a tax rebate or a grant in aid – call it whatever you want.”

Cerino told the commissioners that up until 2014, the incorporated towns received a grant in aid, as much as $110,000 for Chestertown. “I can tell you that has hurt our budget for Chestertown,” he said. “That’s not just a problem for Chestertown; that is a county-wide problem. Because this is where a fourth of the people live. This is where most of the businesses are. This where all the hotel rooms are. We have twenty-five miles of roads that we need to maintain. When the county gets in a little bit of trouble in a recession, and one of the first cuts is cut to the towns, that is a cut to your own constituency.”

Cerino went on to list a number of towns all over the Shore with the amount of tax differential they receive, ranging from 13 cents per $100 assessed value in Easton to 6 or 7 cents in some smaller towns. He also listed rebates received by towns in other Shore counties, ranging from $3.3 million in Ocean City to $13,000 in Cecilton. He then said, “I requested a 5-cent differential. That would have been the lowest figure on this list. And you guys came up with a goose egg again.” He observed that the towns he listed “all have their own police force; they all have their own street crew; and probably they all have their own planning and zoning. Somehow, their counties figure out a way to compensate them fiscally for the inequities in the system. And we can’t do it.”

He went on to address the county budget directly. “When you’re showing a $50 million budget, of which Chestertown probably funds more than a quarter, and you’re telling me you can’t pony up $40 grand a year […] to compensate for services we’re already paying you for, I’m telling you that is a scam. But what adds hurt to the scam is, we don’t really know what’s going on. We need to be more vigilant. That is not right. And I feel for the school system, I feel your pain, and I have my kids in the public schools. I know you guys have a tough job. But if you cannot find $150, $250 grand for Chestertown, which funds at least a quarter of your budget every single year, to me that is bogus. There’s just no other way to put it.” Both Cerino and Foster were greeted by applause from the large audience.

The commissioners are scheduled to vote on the FY2020 budget at their meeting Tuesday, June 11. The meeting begins at 6 p.m. and will take place in the county commissioners’ hearing room at 400 High St. in Chestertown.

Marty Stetson - Councilman Chestertown says

We have a Council of Government meeting where all the incorporated towns come together and meet with the Commissioners. I bring up the tax differential and have done so for at least the last seven or eight years. I get some of the most feeble excuses you could possible hear. One was you provide garbage collection for your residents and the county residents pay for there collection. We were not asking for help for garbage collection, but for police, roads and planning and zoning which Chestertown provides, the county provides to all other citizens of Kent County but not to the residents of Chesterton. Another feeble excuse was Washington College does not pay taxes, if they paid something maybe the county would consider it. My answer to that was because the college fails to meet there obligation why would that give you a pass to not meet your obligation to the citizens of Chesterton. We truly need a Commissioner who lives in Chestertown and understands its problems. I should add, I do not plan on running for County Commissioner – never.

Gren Whitman says

Now that Rock Hall has elected a mayor and council with savvy and gumption, I am confident that Mr. Cerino will find Ms. Jacobs right beside him in front of the commissioners next year.

The other interesting suggestion was having the county budget subjected to an efficiency study. I’m sure that will pop up again.

Ron Jordan says

You elect idiots, you get idiots responses. Don’t get mad, elect competent public servants, pretty simple.

David Foster says

Kent County Property Tax Differential

Although some people have sought to portray the conflicts over the Kent County Budget as a fight between supporters of increased funding for our public schools and those who support a Tax Differential for those who live in municipalities, this is not true. As was evident last Tuesday, many of us strongly support both activities and I have never heard Chestertown residents, regardless of whether or not they have school-age children, complain about paying taxes to support our schools.

I also want to emphasize that although I disagree with our County Commissioners on some issues, I still believe that they are all trying to do their best to help Kent County. As a member of the Chestertown Town Council, I know how hard it is to meet the needs of just 5,000 town residents. I can only imagine how tough it must be to meet the needs of 20,000 urban and rural people spread throughout this beautiful county.

Tom Mason and I actually both wish that Washington College could provide more financial support to our Town. Where we disagree is when some seek to use this problem as an excuse to deny the residents of Chestertown a Tax Offset or Differential to compensate for the fact that the county provides Chestertown residents with little or no assistance for street maintenance and law enforcement.

Bob Jacob and I agree on the need for increased economic development throughout Kent County. We also agree with the need to attract more young families. Where we disagree is when he proposes to deny any form of tax differential and thus systematically imposes the highest property tax burden directly on the areas best positioned to attract new businesses.

Ron Fithian has clearly worked longest and hardest to provide services to our county while minimizing tax increases and he is right that our Commissioners did not create but inherited the current tax system that penalizes municipal residents. Where I disagree, of course, is with any suggestion that such an inheritance absolves us from trying to solve the problem, even if it has been around for 50 to 150 years.

I believe that our County Commissioners, working closely with municipal officials, do have the capacity to overcome our current problems. History tells us that our forebears also grappled with change and so can we. While we still have much more to do, Kent County has made major progress in overcoming racial discrimination and providing equal protection for all its citizens. The time has come to recognize that we can no longer arbitrarily penalize any group based on its place of residence any more than we can discriminate on the basis of race, religion, national origin, or sexual orientation. The first steps in solving any problem are to recognize that we have one and then to adopt systematic plans for overcoming it. No one expects that plan to solve the problem overnight but it must begin with substantive steps and determination to work together. I personally pledge my assistance in this effort.

Sincerely,

J. David Foster

1st Ward Councilman, Chestertown, Maryland

410 708 8244

Susan Drumheller says

After years and years of same old elected officials, who basically got way too comfortable in their political seats were going no where fast.

Rock Hall’s new refreshing team of officials can now regroup, reclaim and prioritize the mess that was left to them. Perhaps some of the kent county commissioners board members could use a tweaking as well ? 😉 We all need savvy business men & women to get the job done right !