Providing clean, reliable and affordable electricity has been the paramount focus for Exelon Generation and the Conowingo Dam for the last 90 years.

In December 2017, The Chesapeake Bay Foundation in conjunction with The Nature Conservancy released a statement and accompanying report by Energy & Environmental Economics (E3) that incorrectly assessed the economic status of the Conowingo Dam. The NorthBridge Group, performed a detailed analysis of the E3 report and found that the E3 conclusions are fundamentally flawed due to a gross over-estimation of the future revenues of the Conowingo Dam.

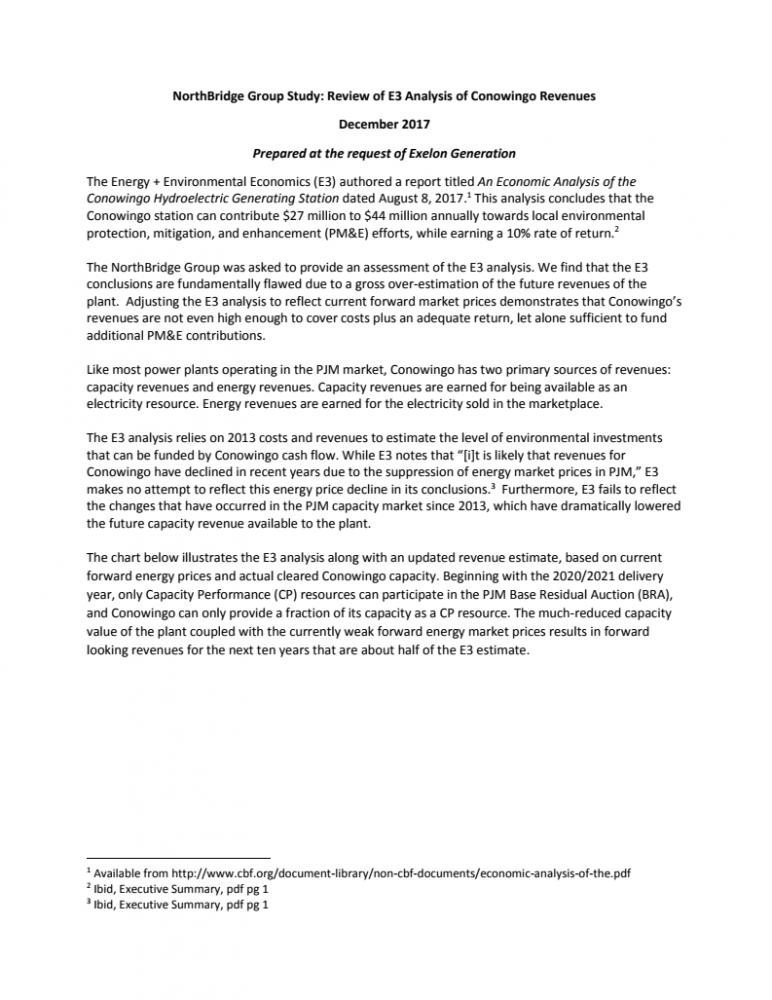

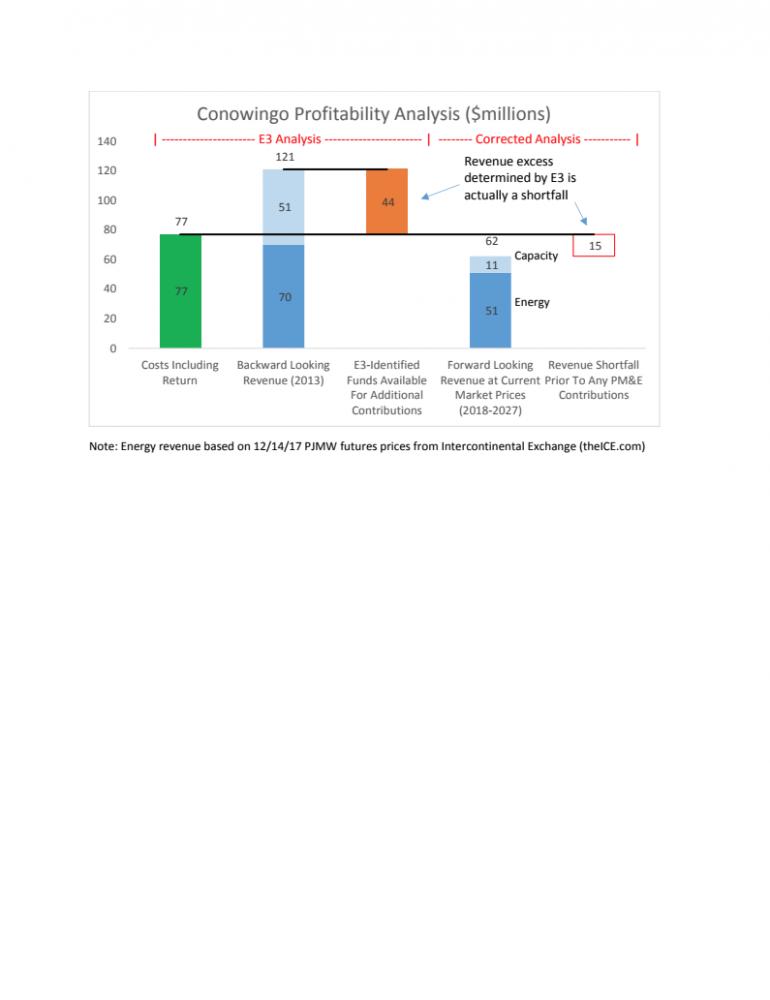

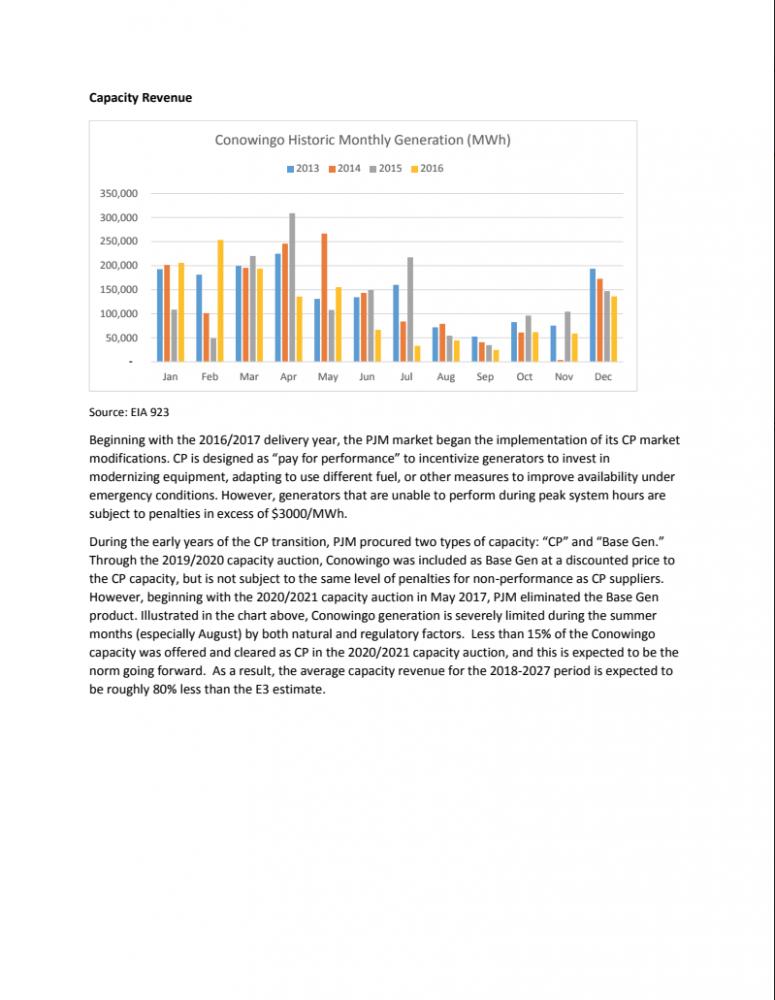

The E3 report inaccurately inflates future revenues in two ways. First, the report greatly overestimates the dam’s capacity revenue, which Conowingo earns for being available as an electricity resource. The dam’s capacity revenue going forward is expected to be roughly 80 percent less than the E3 report estimate. Second, the report bases Conowingo’s future revenues on 2013 energy prices, which are much higher than today’s prices and expected future energy prices. Energy prices in the market available to Conowingo were 30-45 percent lower in 2016 and 2017 versus 2013, yet the E3 report ignored this fact.

When the E3 analysis is run using current information, the analysis demonstrates that Conowingo’s revenues are not even high enough to cover costs plus an adequate return, let alone sufficient to fund additional contributions for sediment. Conowingo provides significant benefits to the region, as confirmed by more than 50 studies since 2010.

As a member of the Chesapeake Bay community, Exelon Generation remains steadfast in our commitment to helping identify the most effective ways to address the health of the Bay.

Exelon Generation

Kennett Square, PA

NorthBridge Group Report

tom zolper says

Nancy Ryan, a partner in Energy + Environmental Economics, offered this response to, “Exelon: Analysis Shows Conowingo Revenues Insufficient to Fund Additional Sediment Mitigation:”

“A key difference in the two financial assessments is that the analysis by Energy + Environmental Economics relies upon historic price trends and Exelon’s publicly filed estimates of revenue from Conowingo, while the analysis by Northridge uses predictions of future prices and ignores the data in Exelon’s filings. ”

Environmental Economics is the San Francisco consulting firm which conducted the Conowingo revenue analysis for the Water and Power Law Group, The Nature Conservancy, and the Chesapeake Bay Foundation.

Alison Prost, Maryland Executive Director of the Chesapeake Bay Foundation, offered this response to the article:

“We look forward to the opportunity to meet with Exelon to discuss the financial analyses and come to a better understanding of the analytical methods and data that underpin the competing findings.”

Chip MacLeod for the Clean Chesapeake Coalition says

So we have a Chesapeake Bay Foundation/The Nature Conservancy report claiming Exelon is rich and can easily afford to financially participate in mitigating the downstream ecological damage to the Bay attributable to loss of trapping capacity behind Conowingo Dam and now a report from Exelon claiming they are poor and can barely make ends meet in their operation of Conowingo Dam. Are CBF and Exelon suggesting an income test for polluters? Where was CBF’s sensitivity to affordability when advocating for unproven and cost-ineffective mandates on Maryland property owners, farmers, businesses and local governments in the name of “saving the Bay” – while referring to the environmental problems with Conowingo Dam as a red herring? (see CBF website for 11/2/12 press release). It’s been suggested by some that if Exelon is pushed too hard to help with addressing the Conowingo factor in the context of Bay restoration and meeting EPA’s TMDL goals, they will just walk away from the dam. Really? Conowingo Dam, as the largest renewable energy generation facility in Maryland, is a flagship in the Exelon portfolio, with bragging rights (and handsome renewal energy credits). Exelon is a Fortune 100 company with 2016 revenues of $31.4 billion, and control of roughly 80% of Maryland’s energy market. Given that Exelon has not spent a dime on sediment management in the full reservoir above the dam (while Maryland local governments, businesses and taxpayers have literally spent billions of dollars downstream to improve water quality), they can’t be crying ‘uncle’ too soon with a straight face. Meanwhile, the Susquehanna River continues to be the single largest source of pollution loading to the Chesapeake Bay, and even more so during storms when accumulated sediment and nutrients above the dam are scoured into the Bay in shock-loading proportions… Since the summer of 2012, local officials involved in the Clean Chesapeake Coalition have been raising awareness and advocating for a plan to address the obvious Conowingo factor – which was a blind spot in EPA’s 2010 Bay TMDL and was ignored in the 2014 Bay Watershed Agreement and has been downplayed by leading environmental organizations, until recently.

Scott Budden says

So many questions stem from this rebuttal. Here are a few off the top:

1) As a publicly traded company, is Exelon’s historical and projected P&L for just the Conowingo, available to the public? If asked, would they release it? Or could The Spy obtain? I’m skeptical that such a successful Fortune 100 company would continue to operate a project that is projected to barely generate “an adequate return”.

2) If Exelon’s claims are true (and can be validated via #1), what happens in the event of a man-made or natural catastrophe (e.g., hurricane floods blowing out emergency floodgates, dam structural failure, etc.) given the narrow profit margin this is expected to yield? Will Exelon invest in emergency remediation measures and subsequent costly repairs? Or will it be handled more akin to how a lackadaisical landlord operates? And what about new hydroelectric upgrades, as technology evolves? Will this dire financial situation force them to invest in more efficient solutions (yielding better returns and cheaper, more efficient energy), or will they have a tough time justifying such efforts?

3) Perhaps it is time for Maryland to start soliciting offers from other companies that are able to operate the dam in a more profitable manner, thus enabling more contributions to environmental mitigation. As the state that is “Open for Business” why not have the best operator in place, to better contribute to our tax base and offset the environmental cost of doing business? Since energy pricing is out of any one company’s control (thankfully), increased profitability would have to be obtained through increased efficiency/cost-reductions. Which, if Exelon’s projected claims are true, one would think they have to be looking at that anyway. If not, this is just misleading PR and they should be publicly shamed for attempting to mislead the public and their shareholders. But again, if the claims hold water (hehe), perhaps it’s time we open this up to a competitive bidding process and allow leaner/more efficient companies to compete