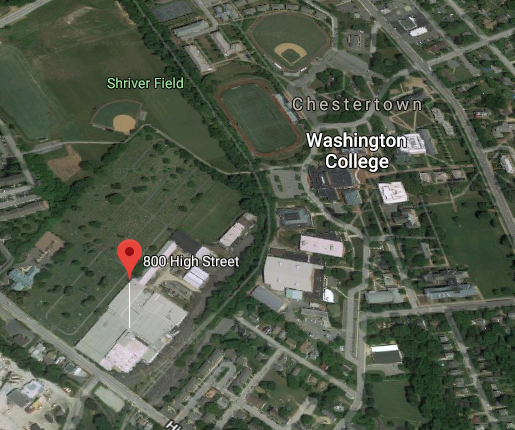

KRM Development Corp. President Kate Gray confirmed today that the company has gifted the Dixon Valve & Coupling facility at 800 High Street to Washington College. The transaction was completed yesterday, Gray said.

KRM Development Corp. President Kate Gray confirmed today that the company has gifted the Dixon Valve & Coupling facility at 800 High Street to Washington College. The transaction was completed yesterday, Gray said.

The 11-acre property has an assessed value of nearly $3.4 million, according to state tax records–and it accounts for about $14,500 in annual tax revenue to the Town of Chestertown and $34,000 to Kent County.

The High Street facility is adjacent to the northern leg of the town’s Rail Trail, which runs from High Street to Morgnec Road.

Under the terms of the gift, the company will continue to maintain manufacturing operations and administrative offices at 800 High Street until its new Chestertown Business Campus on Warner Drive is completed–in about two years, Gray said.

Kent Athletic and Wellness Center, located at the north most end of the High Street facility, will be operated by the YMCA beginning the first of the year. This will be temporary until a new YMCA facility is built at the corner on Haacke Drive and Scheeler Road.

Washington College President Kurt Landgraf praised KRM and Dixon as a long-time supporter of the college’s mission.

“The gift by KRM of 800 High Street is extremely important for Washington College,” Landgraf said in a press release on Tuesday. “Its proximity to the College gives us the potential for a range of options.”

“Dixon and KRM have been consistent supporters of the College, by hiring our alumni, creating terrific internships for our students, and standing shoulder-to-shoulder with us on so many of the challenging issues which face Chestertown and Kent County,” Landgraf said. “Our gratitude is deep and heartfelt for this remarkable donation, and for all of their continued and many-faceted contributions to Washington College.”

Don Sparks says

Another property off the Tax books!

Marty Stetson says

I was wondering if the Chestertown can expect to get $ 14,500 payment in lieu of taxes (PILOT) each year. Which is common in other areas around this state and many of the other states and towns in the U.S.A. Or will it be one more hit on our tax base that the home owner and other small business owners have to make up because of the loss of the taxes on previously taxable property. Chestertown is slowing losing more area that falls into the nontaxable category than it has in the taxable category. The college, churches, hospital bring in jobs but do not make up for the deficient that comes from owning non taxable property.

John Seidel says

Queue the predictable comments about the tax base, often from people who should know better. Overlooked – again – are the following:

A. At the same that this gift is being made, Washington College is selling other properties, including the Lamotte parcel at the corner of Rts. 213 and 291, houses up and down Washington Avenue, and Stepne, northwest of Cross St. (a property the College never wanted to own for so long).

B. Washington College PAYS TAXES on properties not used for academic purposes, which almost certainly will include this one.

C. And has been explained so many times, by so many people, PILOTS may be fine for an institution with a huge endowment, but when a college operates on a razor thin margin, it’s a lousy idea. The economic futures of the Town and the College are joined at the hip, so be careful what you wish for.

Disclaimer: written solely as a Chestertown resident and taxpayer, not as a College employee.

matthew weir says

John, Thank you for reminding people of the simple fact that any college-owned property used for non-institutional purpose is not excluded from real estate tax. Joe Holt, some time ago, listed all college-owned property that pays taxes. The amount of money is not insignificant!

Marty Stetson says

How about listing all the property and land that does not pay taxes. I am a big fan of the college , I love the fact they are with us here in town – but if they would just pay half the tax rate on all their non-taxable property it would do much to lessen the burden on all of the other tax payers here in town.

Joe Lill says

What hasn’t been discussed is the fact that these Chestertown non-profits provide jobs for many Chestertown residents who DO pay taxes. How many Chestertown residents would be unemployed if the College and Hospital weren’t there? This gift to the College DOES offer many possibilities, all of which will create more jobs….and more taxpayers for Chestertown. In the long term this is a win for both the College and the Town.